The Yield Evolution:

A 2026 Strategic Outlook for

YieldMax & Defiance & Roundhill

For the last twenty-four months, income investors have participated in a modern-day Gold Rush. This hasn't been a search for physical nuggets, but a systematic harvesting of volatility in the options market. Funds paying annualized distributions of 40%, 60%, or even 100% became commonplace. However, the landscape is maturing. As the market heads toward 2026, mainstream financial media and market critics are debating the sustainability of these payouts. The common bear case suggests that as interest rates decline and the stock market stabilizes, the premiums driving these high-yield vehicles will compress.

This analysis seeks to move beyond speculation and provide a data-driven educational framework for the years ahead. A review of the Federal Reserve’s "dot plot" forecasts, 2026 option volatility surfaces, and tax regulations reveals a nuanced reality: The yield opportunity isn't disappearing, but the environment is evolving. For the High-Yield Sovereign, the strategy must adapt to match this new cycle.

1. The "Fed Floor" Provides a Safety Net

A pervasive myth suggests that YieldMax funds require sky-high interest rates to function. The argument posits that if rates drop, collateral income—a key component of the distribution—will vanish.

The Reality: The Federal Reserve’s own projections (the "Dot Plot") for 2026 show the federal funds rate settling around 3.4% – 3.6% [1].

It is crucial to understand the architecture of these funds. TSLY does not hold Tesla stock; NVDY does not hold Nvidia stock. These funds hold "synthetic" positions backed by US Treasuries. Currently, funds like NVDY hold Treasury Notes maturing in early 2026. Upon maturity, these will be rolled into new notes.

Unlike the 2020 era, when rates hovered near 0% and collateral paid nothing, the 2026 environment is projected to offer a 3.5% base yield before a single option is sold. While this is lower than the 5% risk-free rate of 2024, it creates a "Fed Floor"—a defensive baseline that supports the fund's foundation.

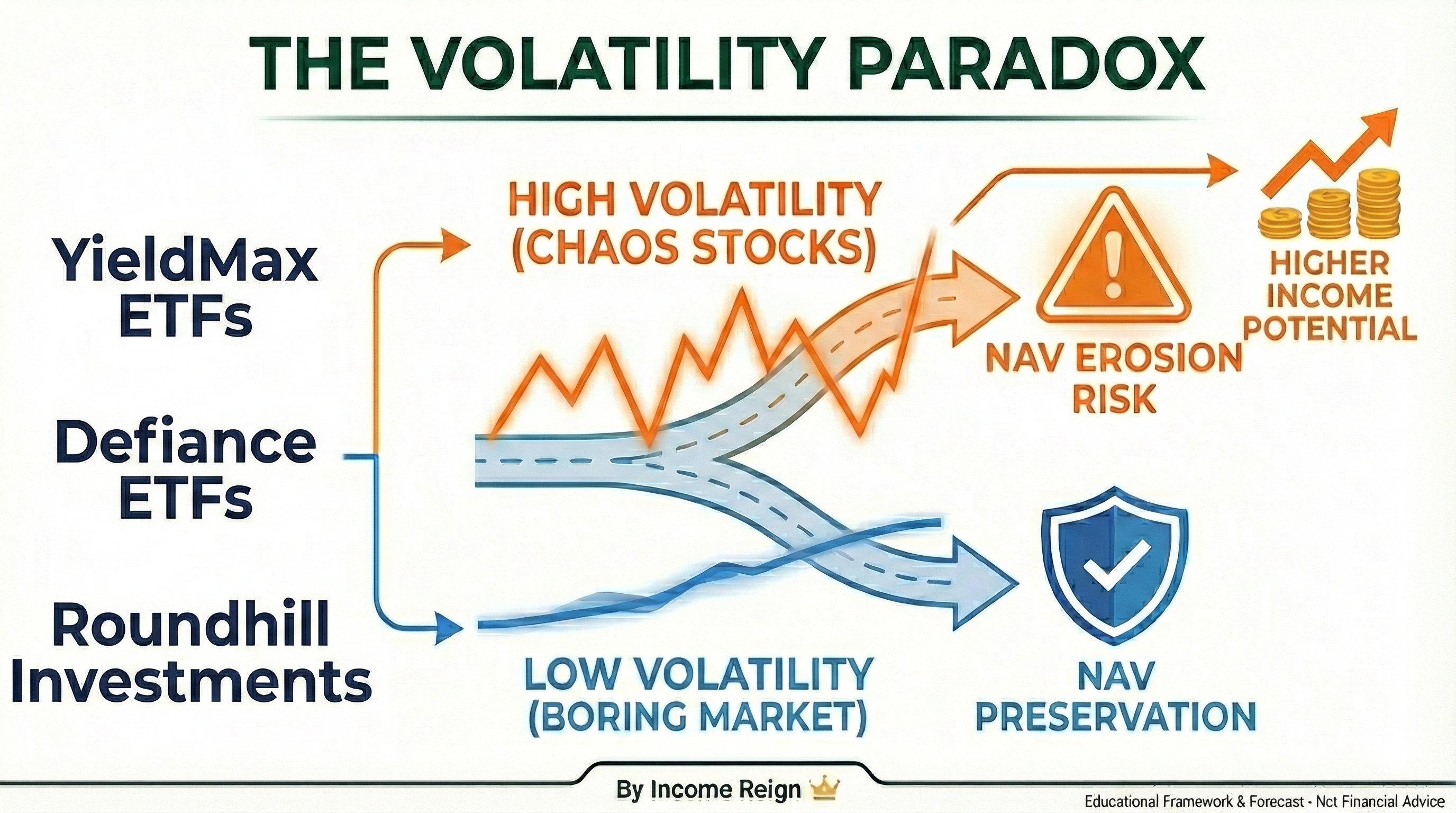

2. The Volatility Paradox: Yield vs. Preservation

YieldMax and Defiance and Roundhill strategies rely entirely on Implied Volatility (IV). However, strictly chasing the highest IV without understanding the mechanics can lead to suboptimal outcomes.

- High Volatility (Chaos Stocks): = Higher Premiums, but increased risk of NAV Erosion.

- Low Volatility (Boring Market): = Lower Premiums, but increased probability of NAV Preservation.

The Education:

High volatility often correlates with erratic price action. Because covered call funds generally have capped upside but uncapped downside, "Chaos Stocks" present a specific risk profile. If the underlying asset drops significantly (downside participation) and then rebounds sharply (capped upside), the fund's NAV may struggle to recover its previous highs.

The Low VIX Dynamic:

The forecast for the broad market (S&P 500) suggests volatility may dampen in 2026 (VIX 12–15) [2]. While this may reduce the yield of index funds like WDTE, low volatility historically correlates with a "slow grind up." This environment is often favorable for NAV preservation, as the underlying asset rarely crashes, allowing the NAV to potentially drift higher alongside the distributions.

The Strategic Outlook:

Analysis of option chains for Tesla (TSLY) expiring in late 2026 shows the market is still pricing in significant volatility—ranging between 54% and 58% [3].

The Lesson: In 2026, investors should understand the trade-off:

- Broad Market Funds (WDTE/SPYI): May offer lower yields (15-20%) but structurally benefit from lower volatility trends that protect NAV.

- Single-Stock Funds (TSLY/NVDY): May offer higher yields (50%+) due to "sticky" volatility, but require a bullish-to-neutral conviction on the underlying asset to avoid NAV erosion.

3. The "Return of Capital" Trap

Understanding the composition of your distribution is critical for long-term sustainability. Funds often report distributions that include Return of Capital (ROC).

ROC is a double-edged sword that requires careful interpretation:

- Constructive ROC: The fund generates cash flow but uses accounting losses to classify payouts as ROC. This defers taxes and lowers the cost basis until the position is sold.

- Destructive ROC: The fund pays out capital while the Net Asset Value (NAV) declines. This represents the erosion of principal.

The Income Reign Rule: Focus exclusively on Total Return (Price Change + Dividends).

A high distribution rate is only beneficial if the Total Return is positive. Investors should monitor NAV trends to ensure that the payout is not simply returning their own principal at a loss.

4. The 2026 Playbook

To navigate the evolving landscape of 2026, the High-Yield Sovereign should consider the following educational points:

- Embrace Sustainable Yields: As the market matures, yields may normalize from outlier levels (80%+) to sustainable ranges (30–40%). This normalization often signals a healthier, more stable fund structure compared to the distress signaled by triple-digit yields.

- Frequency vs. Fundamentals: While weekly payouts accelerate compounding, they do not alter the fundamental performance of the fund. Investment decisions should be based on the underlying strategy, not the payout schedule.

- Asset Location Awareness:

- Single-Stock Funds: Generally generate Ordinary Income.

- Index Options: Funds like Defiance’s WDTE (trading S&P 500 options) often qualify for favorable 60/40 tax treatment under IRS Section 1256 [4]. Investors should consult a tax professional to optimize asset location (IRA vs. Taxable Account).

- The Bullish Requirement: High volatility funds (NVDY, MSTY) function best when the underlying asset is flat or rising. If your outlook on the underlying stock is bearish, the high yield is unlikely to compensate for the capital depreciation.

Final Verdict

The yield is not disappearing, but the era of "easy money" is evolving into a market that rewards discipline. The coming years will distinguish investors who understand asymmetric risk—where capped upside meets full downside—from those who merely chase the highest number.

References & Data Sources

[1] Federal Reserve Interest Rate Projections (The Dot Plot)

- Source: Federal Open Market Committee (FOMC) Summary of Economic Projections.

- Link: Federal Reserve FOMC Calendars & Projections

- Data: The median projected federal funds rate for year-end 2026 is 3.4%.

[2] CBOE Volatility Index (VIX) Historical Data

- Source: Cboe Global Markets Data.

- Link: Cboe VIX Index Overview

- Data: 52-Week Low for VIX is 12.70; Long-term mean reversion often targets the 12-15 range.

[3] Tesla (TSLA) Option Volatility Surface

- Source: OptionCharts.io / Fintel Labs.

- Link: Tesla (TSLA) Implied Volatility Skew

- Link: Fintel TSLA Volatility Data

- Data: Implied Volatility (IV) for TSLA options expiring in 2026 tracks between 54% and 58%.

[4] IRS Tax Treatment: Section 1256 vs. Ordinary Income

- Source: Internal Revenue Code Section 1256; IRS Publication 550.

- Link: IRS Publication 550: Investment Income and Expenses

- Link: Investopedia: Section 1256 Contract Definition

- Data: "Nonequity options" (like S&P 500 index options used by WDTE) qualify for 60% Long-Term / 40% Short-Term capital gains rates.

Legal Disclaimers & Risk Disclosure

No Investment Advice

The content provided in this article is for informational and educational purposes only and does not constitute financial, investment, legal, or tax advice. The views expressed herein are those of the author and do not necessarily reflect the official policy or position of any other agency, organization, employer, or company. Income Reign is not a registered investment advisor, broker-dealer, or financial analyst.

No Recommendations: The mention of specific securities or ETFs is not a recommendation to buy, sell, or hold any investment. It is for illustrative purposes only.

Risk of Loss

Investing in financial markets involves a high degree of risk, and there is always the potential of losing money when you invest in securities. The investment strategies mentioned, specifically those involving high-yield ETFs and derivative-based products (such as YieldMax, Defiance, or similar funds), carry significant risks, including the potential loss of the entire principal amount invested. These funds often employ complex option strategies that may not be suitable for all investors.

Past Performance

Past performance is not indicative of future results. Historical returns, yields, and distribution rates are hypothetical or historical in nature and are not a guarantee of future performance. The "Yield" percentages mentioned are annualized based on recent distributions and may fluctuate significantly.

Tax Disclaimer

Tax laws are subject to change and may vary depending on your specific circumstances. References to tax treatments (e.g., Section 1256, Return of Capital) are based on current understanding of the tax code but should not be relied upon for tax planning. You should consult with a qualified tax professional regarding your specific tax situation.

Affiliate Disclosure

This post may contain affiliate links. If you click on a link and make a purchase or sign up for a service, Income Reign may receive a commission at no additional cost to you. Income Reign is not affiliated with YieldMax, Roundhill, or Defiance.